E-Commerce and the Ascent of the Digital Economy

The explosive growth in the digital economy in 2020, is directly attributable to the pandemic that crossed the globe at late last year. No part of the global economy has been left untouched.

Analysis of online transactions across a multitude of devices and social media channels, industries and product categories in any part of the world. Demonstrate a significant shift to online activity by consumers who are veterans of the internet and first-timers

Regional Upswings – South East Asia

The internet economy is expected to grow to US$300bn primarily driven by growth in eCommerce, ride-hailing and digital payments.

The biggest shifts in online shopping include the procurement of daily essentials online, the discovery of new apps that provide digital solutions and an increase in searches relating to the value of money, health and welfare and a commitment to contactless payment solutions.

39% of consumers in South East Asia (SEA) said they are less than satisfied with their digital commerce experience, citing concerns about ecommerce fulfilment costs and services, product reliability and the authenticity of in-app reviews. (Source: Blackbox Research & Touluna)

While 56% of Gen Zs reported more online spending, the increase is also driven by older consumers, with the largest increases occurring amongst Gen X (60%) and millennial cohorts (59%). (Source: Bain & Company)

Indonesia (54%) and Malaysia (57%) recorded the lowest satisfaction levels in the region when it comes to online experiences. (Source: Bain & Company)

Four in five SEA consumers said they were more likely to support local brands in the future. Driven by a desire to strengthen their local communities and economy. (Source: Bain & Company)

There is a huge opportunity for brands to capture a greater percentage of new consumers going online. With a significant number of new consumers engaging with a wide range of apps for the first-time.

Companies will need to raise their game to capture new ecommerce business, reimagine their ecommerce websites and deliver data-driven engaging ecommerce marketing.

% of South East Asian Consumers Trying More Apps

% of South East Asian Consumer First-Time Users Likely to Continue to Use Apps

Europe and the Middle East

In the United Kingdom, the E-Commerce industry experienced a £5.3bn increase in revenue. Ecommerce online sales are expected to grow from initial predictions of 11% to 19% in 2020. Up from the forecasted value of £66.6bn to £78.9bn in 2020.

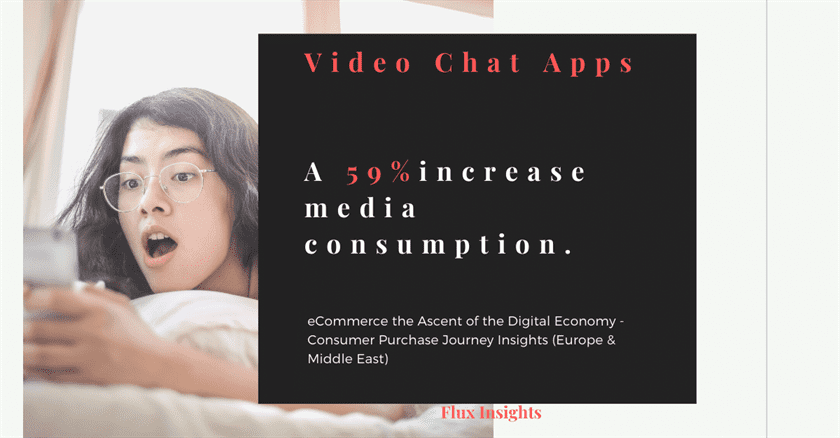

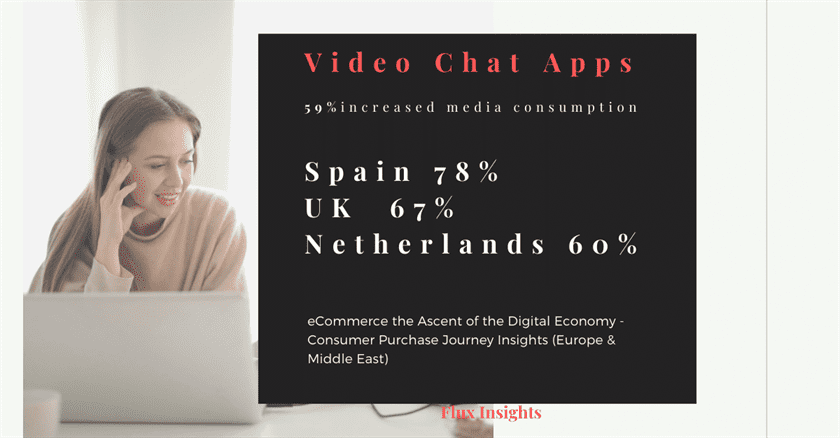

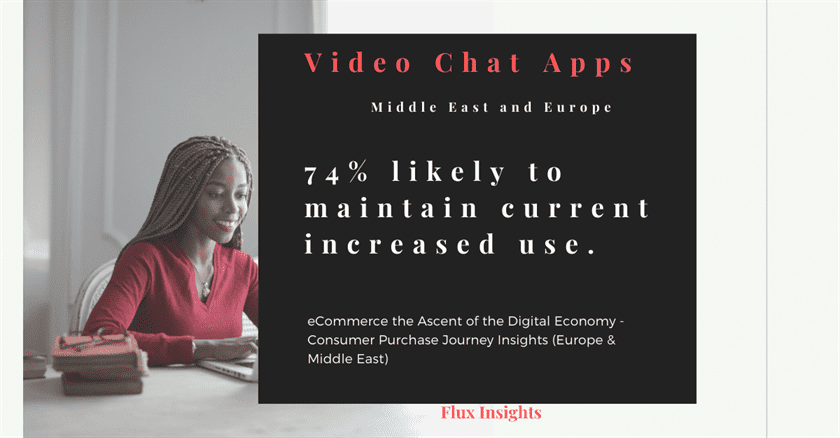

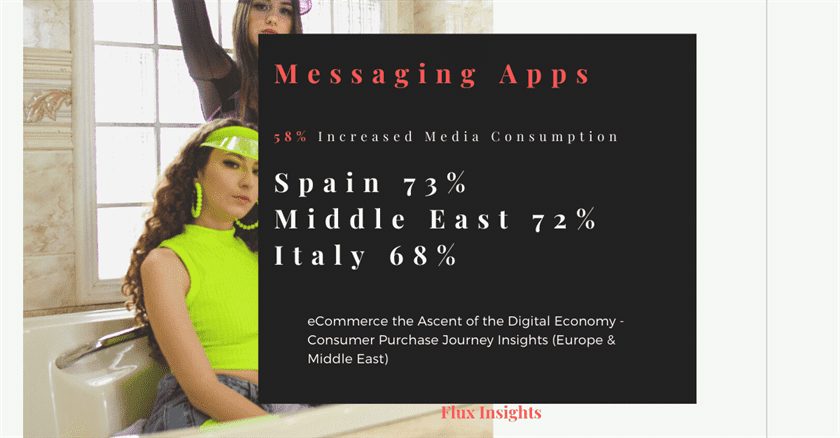

Consumer Purchase Journey Insights -Europe & the Middle East.

Consumer buying habits will become more erratic, volatile and price sensitive. Due to the continued degree of uncertainty. Hence price and value for money will become influential in the purchase decision-making process.

Uncertainty reinforces consumers desire for reassurance when deciding to procure a brand. Hence, neglecting consumer experience in the short-term to exploit the large numbers of new users migrating onto the internet may backfire in the long-term.

Personalisation, the capture, management and analysis of vast amounts of data is going to be critical in customer retention.

Thus digital transformation efforts will continue to occupy the centre stage, as engaging consumers online across the established and new channels will be essential for acquisition and retention strategies. Supported by the right, tech stacks and logistical infrastructure.

Furthermore, investment in delivering seamless humanised online consumer experience, the leveraging data, to drive insights, technology to automate manual activities, and foster agility in data-driven decision-making for employees.

Enables the emergence of an environment, where consumers will become long-term advocates of a brand.

First Time Users and Veterans of Apps

Health is Wealth

Consumers focus on self-health increased considerably as a result of Covid-19 .

North and South America and Africa will be covered in two weeks.